Pablo Rosado (purple belt) and his students after the advanced adults BJJ class.

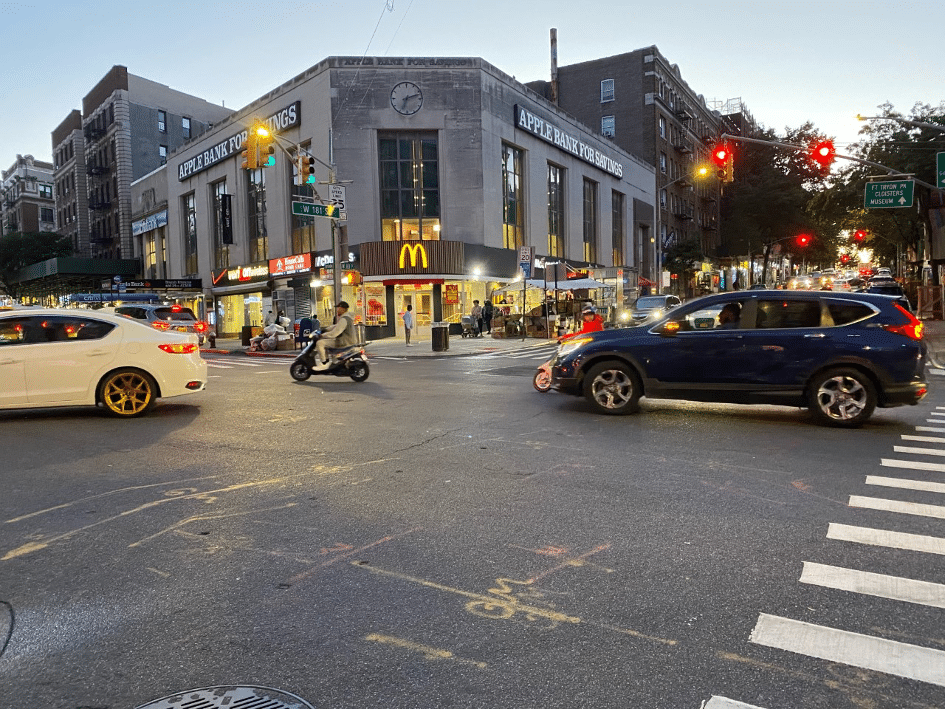

Last September, Pablo Rosado opened the Killer Bees Harlem Hive Jiu-Jitsu Center in West Harlem. He planned to expand his center within the next few years. He imagined a larger space for his students and the addition of programs like yoga, strength and conditioning, and a women’s only Brazilian Jiu-Jitsu, or BJJ, program.

Unfortunately, coronavirus interrupted his dream. New York Governor Andrew Cuomo’s “Pause” order to shut down all non-essential businesses in the middle of March was a mandatory order needed to prevent the spread of this infection. Rosado shut down the doors of his centers and is now skeptical about whether he will receive any promised help for small businesses. The $2 trillion relief package, passed by Congress at the end of March, included $350 million for small businesses to help them for ten weeks.

The demand for these loan programs, like Paycheck Protection Program (PPP), is so intense that their funding could dry up by the end of this week. Lawmakers of both parties realize modifications and extra funds must be added.

Unfortunately, coronavirus interrupted his dream.

“From my experience, there is always some sort of random process that must get done and while doing that process a random thing is needed and then BOOM you don’t qualify,” said Rosado, a 33-year-old Harlem native.

The Washington Post predicted dramatic pressures being put on the Small Business Administration’s (SBA) ability to guarantee loans because millions of companies could seek these guarantees all at once. Paycheck Protection has very specific guidelines that prevent the loans from occurring. The SBA will back up the loans, but businesses need to apply directly to participating banks like Chase and Bank of America. Failure to have a previous loan history could disqualify businesses.

Rosado estimates the closure of his business costs him $1500 a month. He now makes deliveries on his electric bike from West Harlem to areas below Columbus Circle for Postmates and earns about $300 a week.

In the meantimes, Rosado worries about his rent.

“My commercial landlord is semi understanding. He has given me the opportunity to pay half of the rent, but I am still paying for something I am making no money off of,” Rosado said.

Further north on Amsterdam Avenue, the general manager of Grill on the Hill, Warren Terry, said he is living off his savings, which shrink day by day.

“As of now I’m looking into that stimulus check and holding out until the 15th [of April] to apply for unemployment. The little money will help but then what? What after that? Are they going to do it every month?” The bar laid off all 12 workers and has lost about $20,000 in revenue each week, not including food, juices and certain supplies that will go bad.

The little money will help but then what? What after that? Are they going to do it every month?”

“I honestly don’t think you can recover revenue. At the beginning it’s going to be a big spike because everyone wants to get out of the house, but no one has any money or the majority of people don’t, especially those in the service industry. The other aspect is you just can’t recover time—it’s lost,” Terry said.

Rosado is patiently waiting for the current conditions to settle down and appears optimistic. “They come through for big businesses and not small businesses ever, so I am not even going to waste my time, but I am sure I will figure it out on my own,” Rosado said.

Tags: Brazilian Jiu-Jitsu Bryan Campos CCNY City College Journalism Coronavirus COVID-19 Harlem Killer Bees Harlem Hive Jiu-Jitsu Center New York State on Pause NYC Relief Package small business owners

Series: Coronavirus