University Place on the east side of Washington Square Park.

When Erin Lawson was an undergraduate at New York University (NYU), her classmates were surprised that she regularly ventured out of their Greenwich Village campus area. “People at NYU do not leave that cluster,” she explained, referring to a tight assemblage of university-owned properties around Washington Square Park, bound by Houston, 14th street, Broadway, and Sixth avenue. She offered a simple reason, “Because the university is trying to provide a very like, clean, sanitized, mostly white and upper middle class version of what New York is.”

Over the years, NYU has purchased hundreds of buildings, mostly in Manhattan, so that their students can easily live, work, and play in university-owned properties without ever leaving the enclave. It is a big enclave. NYU is the second largest private landowner in Manhattan, surpassed only by Columbia University. Since both Universities are nonprofit institutions, they are exempt from paying property taxes. This legal loophole saves Columbia approximately $182 million and NYU $145 million annually, while allowing them to amass a staggering portfolio of residential and commercial real estate, according to an investigation by the New York Times. Supporters of public colleges and others are working to kill this exemption and use the new funds for public higher education through the “Repeal Egregious Property Accumulation and Invest it Right” Act, or R.E.P.A.I.R.

Lawson, now a community organizer with Students for Higher Education Justice, is fighting to make R.E.P.A.I.R a reality. The law, sponsored by Queens Assembly Member, and mayoral candidate, Zohran Mandani and Queens State Senator John Liu, would end the property tax exemptions for private universities and redirect the resulting revenue to the State University of New York (SUNY) and City University of New York (CUNY). “It doesn’t cost a taxpayer one more dollar, it is just giving CUNY this money that should have already been public,” said Lawson.

In an emailed statement, NYU spokesperson John Beckman reiterated NYU’s overall impact on the community and “charitable educational mission,” which includes providing thousands of jobs for New Yorkers across their campuses, nonprofit healthcare through NYU Langone, and programming in public school classrooms. “To choose two charitable, non-profit organizations [NYU and Columbia University] out of the thousands in the state and compel them to be treated like for-profit entities certainly strikes us as misguided and unfair.”

“As a CCNY student, I always have felt a certain level of resentment towards Columbia students,” explained Kaitlyn Murphy, a student at City College of New York and an organizer for the Young Democratic Socialists of America (YDSA).“I’ve gone to the Columbia campus before, it’s just really a totally different world, and it’s really only a few blocks away,” she said.

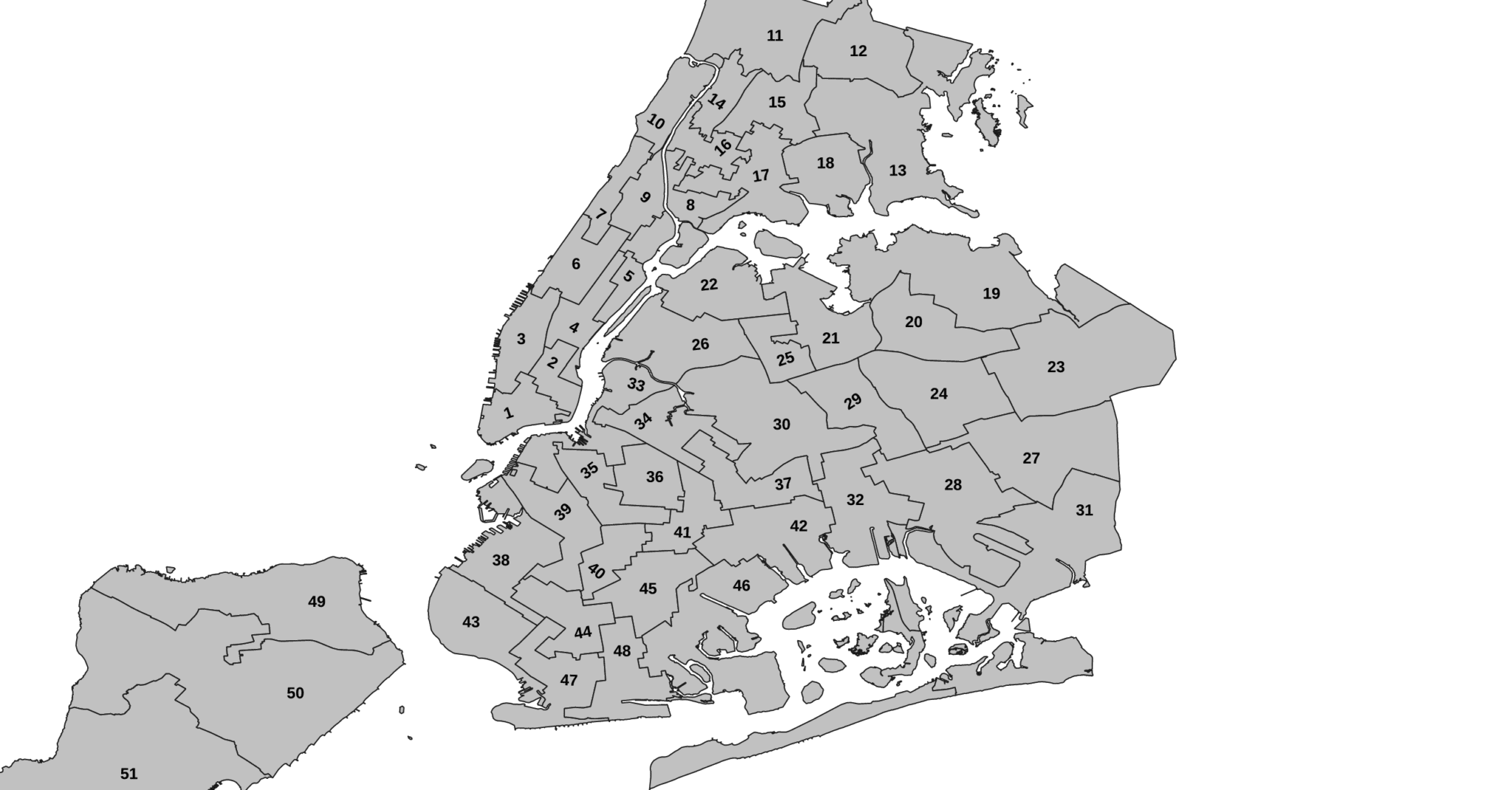

Murphy and Lawson point out that these universities buy neighborhoods in clusters. A geolocation map, built using New York City Open Data’s PLUTO database, visualizes the hundreds of buildings owned by the two universities and reinforces concerns about neighborhood displacement and unchecked expansion.

“We usually associate nonprofits with helping the community,” said Murphy, “They are helping a community of privileged students at Columbia, but not like the greater community of Upper Manhattan.”

While Manhattan’s private universities expand tax-free, the CUNY system has been squeezed. It was fully-funded by the state and free for students for 130 years from 1843-1976. Between 1989 and 2006, the only years that this fiscal data is available, state support of CUNY has decreased from almost 80% to just over 55%. As appropriations shrink, CUNY increasingly relies on tuition and returns from its modest endowment.

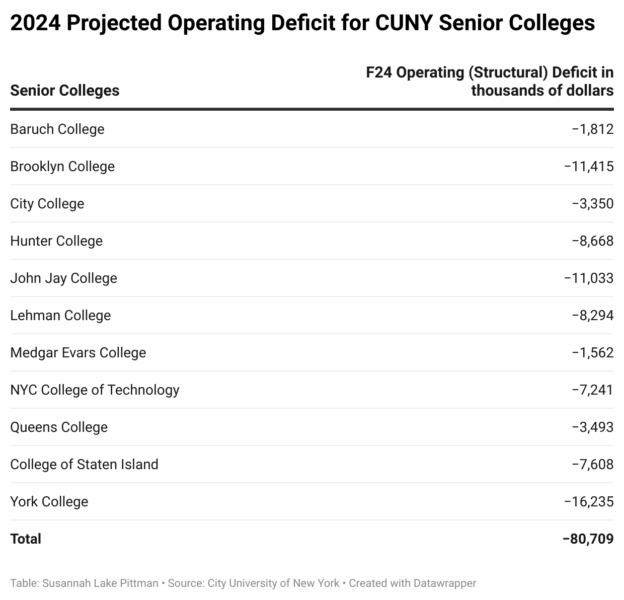

Table demonstrating CUNY senior colleges’ structural deficits provided by CUNY. Visualization by Susannah Lake Pittman.

With state funding plummeting, every single CUNY senior college operates at an annual structural deficit. That means costs outpace income by over 80 million a year.

Research shows that investing in CUNY reaps financial rewards.

The public can expect $8.50 returned over the course of students’ careers for every public dollar appropriated to CUNY, according to a 2023 Lightcast report on CUNY’s economic impact.

If R.E.P.A.I.R. succeeds in redirecting the estimated $321 million from NYU and Columbia to SUNY and CUNY, the projected return could top $2.5 billion for the city.

Tags: Assemblymember Zohran Mamdani City College City University of New York Columbia University Cuny CUNY funding data journalism Erin Lawson gentification Gentrification gentrification in Washington Heights gentrified neighborhoods greenwich village Kaitlyn Murphy morningside heights New York University nonprofit universities R.E.P.A.I.R Repeal Egregious Property Accumulation and Invest it Right Susannah Lake Pittman Susannah Pittman Upper Manhattan gentrification Washington Square Park west village YDSA Young Democratic Socialists of America Zohran Mamdani

Series: Community